What Flood Zones Really Mean When Buying in Western North Carolina

After Hurricane Helene, many Western North Carolina buyers have new questions about flood zones and insurance, and we’re here to answer them clearly.

Flood zones are not new to the mountains, but recent storm events have increased awareness. Buyers want to know whether a property is at risk, whether flood insurance is required, and whether maps are changing. These are smart questions.

At Revelia Property Solutions, we approach flood zones the same way we approach wells, septic systems, and steep terrain. Calmly. Factually. Strategically. Our role is not to create fear, it is to create clarity.

Let’s walk through what flood zones actually mean in Western North Carolina.

What Is a Flood Zone in Western North Carolina?

A flood zone is a geographic area defined by FEMA that reflects the statistical likelihood of flooding.

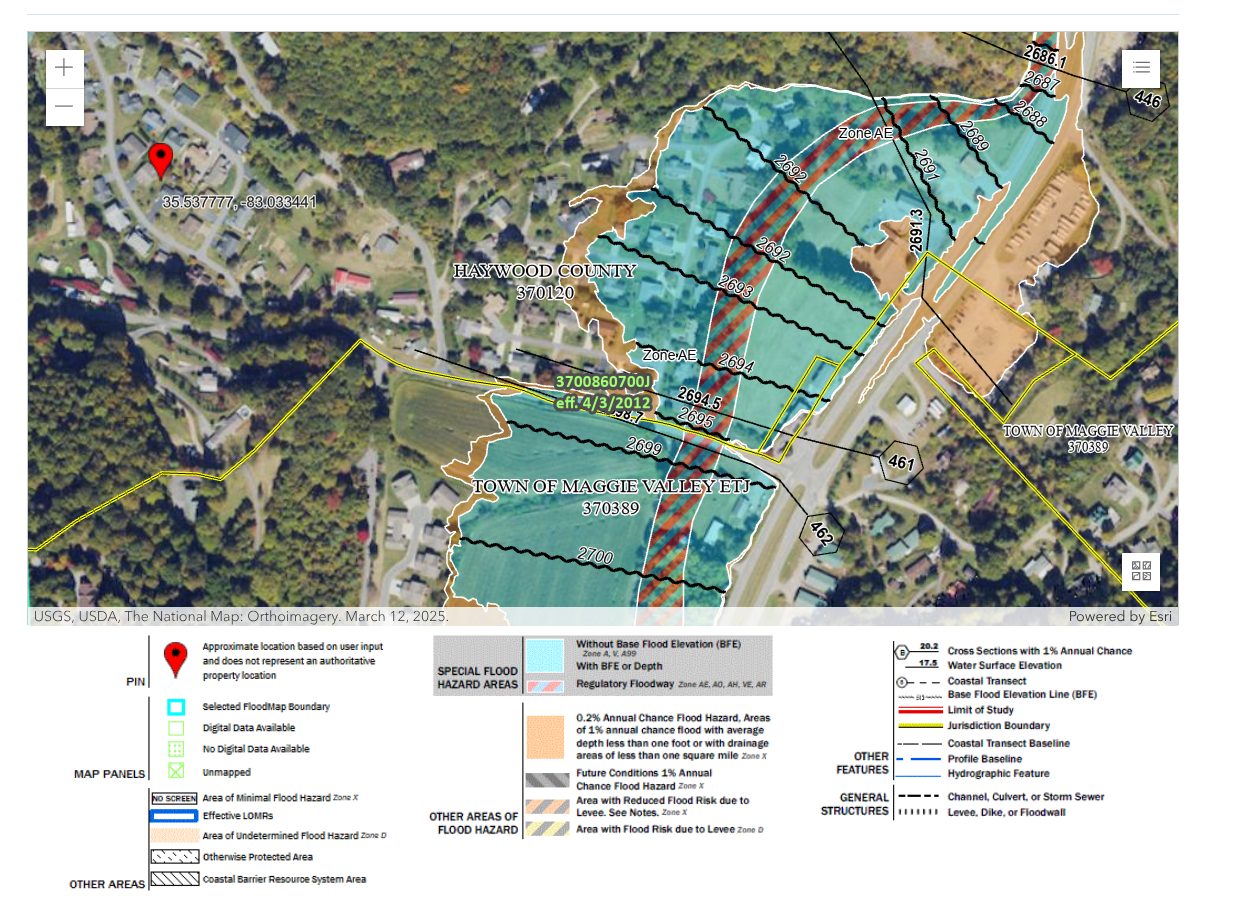

Properties are placed into categories such as Zone X, Zone AE, or Zone A based on modeling of historical rainfall, river behavior, topography, and watershed patterns. According to FEMA’s Flood Map Service Center, these designations are part of the National Flood Insurance Program’s risk modeling framework.

Source: FEMA Flood Map Service Center

https://msc.fema.gov/portal/home These designations do not predict whether a home will flood tomorrow. They indicate probability over time.

In Western North Carolina, flood zones are most commonly found:

• Along river valleys

• Near creeks and tributaries

• In lower elevation basin areas

• Adjacent to mapped floodplains

Mountain ridge properties are far less likely to fall within FEMA flood zones, but valleys in areas like Haywood County, along the Pigeon River and its tributaries, may include designated flood areas.

Flood zone does not automatically mean high danger. It means risk has been modeled.

For example- Haywood County has a great resource that allows you to search on specific addresses and get all the most recent flood zoning information. https://readyhaywood.com/flooding/

Are Flood Maps Being Redrawn After Helene?

FEMA flood maps are periodically reviewed and updated based on new data, development patterns, and significant storm events. FEMA’s Risk Mapping, Assessment, and Planning (Risk MAP) program outlines how communities are reassessed over time to reflect updated hydrologic and topographic information.

Source: FEMA Risk MAP Program

https://www.fema.gov/flood-maps/tools-resources/risk-map

After major weather events such as Hurricane Helene, additional assessments and data collection often occur. That does not mean every property will be reclassified. Map revisions are technical, data-driven processes that can take time.

Buyers should understand that flood maps are tools. They evolve as more information becomes available. When evaluating a property, we always recommend checking the most current FEMA Flood Map Service Center data and local county GIS systems, especially in areas that experienced significant storm impact.

Being informed is not the same as being alarmed. It simply means using the latest available data.

Do You Need Flood Insurance in Western North Carolina?

Flood insurance is required by lenders when a property is located in a high-risk FEMA flood zone. Under federal law governing the National Flood Insurance Program, federally regulated lenders must require flood insurance for structures located within Special Flood Hazard Areas.

Source: National Flood Insurance Program (NFIP)

https://www.fema.gov/flood-insurance

If you are financing a home and it is designated in Zone AE or another Special Flood Hazard Area, your lender will require flood insurance before closing. This is a federal lending requirement, not a discretionary decision by the bank.

If a property is in Zone X or another low-to-moderate risk zone, flood insurance is typically not mandatory for financed buyers.

Insurance costs vary depending on elevation, coverage limits, and flood zone classification. Premiums can range widely, so obtaining a quote early in the due diligence period is essential.

When Is Flood Insurance Required by a Lender?

Flood insurance becomes mandatory when:

• The property is in a FEMA-designated Special Flood Hazard Area

• The loan is backed by a federally regulated lender

• The structure itself sits within the mapped zone

It is important to understand that land within a flood zone does not automatically trigger the requirement. The structure’s location relative to the mapped flood boundary is what matters.

Elevation certificates may also play a role in determining final premium cost.

What If You Are a Cash Buyer in a Flood Zone?

Cash buyers are not legally required to carry flood insurance.

However, choosing not to carry insurance means assuming full financial responsibility for potential flood damage. There is no lender oversight requiring coverage.

Some cash buyers elect to carry flood insurance even when it is not required. Others rely on risk tolerance, elevation positioning, and historical performance of the property.

This is not a one-size-fits-all decision. It should be evaluated based on topography, water proximity, and long-term plans.

Clear information leads to confident decisions.

Are Mountain Homes Actually at Risk of Flooding?

Western North Carolina’s terrain creates both natural protection and concentrated water flow.

Higher elevation homes on ridges generally have lower flood exposure. However, heavy rainfall can cause rapid water movement in valleys, along creeks, and near drainage corridors.

It is also important to distinguish between river flooding and surface water drainage issues. A property can be outside of a FEMA flood zone and still experience water intrusion due to grading, culverts, or stormwater management.

Flood zone designation is only one piece of the evaluation.

How Do Zillow and Realtor.com Flood Risk Scores Differ from FEMA Maps?

Online platforms such as Zillow and Realtor.com often display flood risk ratings that differ from FEMA flood zone designations.

Many of these platforms use third-party climate modeling tools, most commonly data from First Street Foundation. These models evaluate factors such as property elevation, proximity to rivers or creeks, historical flood events, rainfall data, and projected long-term climate patterns. The result is a forward-looking risk score that estimates potential flood exposure over time.

That is very different from how FEMA classifies flood zones.

FEMA flood maps are engineering-based designations used to determine whether flood insurance is required by a lender under the National Flood Insurance Program. Lenders rely on FEMA Special Flood Hazard Area designations, not online climate risk scores, when determining mandatory insurance requirements.

Because these systems measure different things, it is possible for a property to show a “moderate” or “high” flood risk score online while still being located in FEMA Zone X, where flood insurance is not required for financed buyers.

Online flood risk tools can be helpful for general awareness. However, they are screening tools, not underwriting standards. In Western North Carolina, where elevation can change dramatically within short distances, automated models may not fully reflect grading changes, drainage improvements, culverts, or site-specific topography.

Clarity comes from reviewing FEMA maps, county GIS data, elevation information, and on-the-ground conditions together.

How Do Flood Zones Affect Property Value?

Flood zones can influence buyer perception, insurance costs, and financing requirements.

Some buyers are comfortable purchasing within designated zones when pricing reflects the designation. Others prefer to avoid them entirely. Market reaction depends heavily on location and elevation details.

In areas of Haywood County and surrounding river valleys, flood-designated properties still sell regularly. Pricing strategy and transparency matter more than the label itself.

Clarity reduces stigma.

What Should Buyers Review During Due Diligence?

Buyers should review:

• Current FEMA flood map designation (via FEMA Flood Map Service Center)

• County GIS mapping, such as Haywood County GIS

• Elevation certificate if available

• Insurance quotes early in the process

• Historical disclosure statements

• Proximity to creeks, rivers, and drainage channels

Source: Haywood County GIS

https://www.haywoodcountync.gov/154/GIS

Source: North Carolina Flood Risk Information System

https://fris.nc.gov/fris/

• County GIS mapping

• Elevation certificate if available

• Insurance quotes early in the process

• Historical disclosure statements

• Proximity to creeks, rivers, and drainage channels

Due diligence is about understanding the full picture, not reacting emotionally to one data point.

At Revelia Property Solutions, we walk clients through flood mapping the same way we walk them through well logs or septic permits. Systematically. With context. Without drama.

Why Work With a Local Team When Buying Near Rivers or Creeks?

Local knowledge matters when evaluating flood risk.

Topography in Western North Carolina can change dramatically within a short distance. Two homes on the same road may have entirely different flood exposure depending on elevation and grading.

We understand the difference between mapped floodplain, functional drainage patterns, and true long-term risk. We also help buyers interpret what insurance requirements actually mean for their specific financing scenario.

Experience removes uncertainty.

Conclusion

Flood zones in Western North Carolina are not something to ignore, and they are not something to panic over.

They are data points. They are part of a larger evaluation that includes elevation, water proximity, insurance requirements, and financing structure.

After Hurricane Helene, awareness is higher. That is understandable. The key is responding with information rather than emotion.

If you are considering purchasing property near a river, creek, or valley area in Western North Carolina, let’s review the flood maps and insurance implications together before you make an offer.

Clear guidance leads to confident decisions.

Frequently Asked Questions

Q: Can a property flood even if it is not in a FEMA flood zone?

A: Yes. FEMA flood maps reflect modeled risk, but localized drainage issues or extreme weather can still cause water intrusion outside mapped zones.

Q: How much does flood insurance cost in Western NC?

A: Costs vary based on elevation, zone designation, and coverage limits. Obtaining a quote early during due diligence is the best way to understand real numbers.

Q: Can flood zones change over time?

A: Yes. FEMA periodically updates flood maps based on new data and storm history. Buyers should always review the most current map version.

Q: Does flood insurance cover mudslides?

A: Standard flood insurance typically covers rising water, not earth movement. Mudslides may fall under separate coverage categories depending on policy terms.

Q: Should a cash buyer carry flood insurance?

A: While not required, some cash buyers choose to carry flood insurance for risk protection. The decision depends on individual risk tolerance and property specifics.

Ready to Make Your Move in Western North Carolina?

We help buyers and sellers across Western North Carolina, including Haywood, Jackson, and Buncombe counties, move forward with clarity and confidence.

Jason Revelia

Call 828-342-1334 |

Email Jason

Shannon Revelia

Call 828-226-6767 |

Email Shannon

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link